Town Centre Revival: Is The High Street Making A Come Back?

For years now, we’ve been told how the high street is dying with stores closing, and footfall still below pre-pandemic levels. But if you look closely, the story isn’t just about decline. Some town centres have been reinventing themselves, and for the businesses that understand where and why, there’s still opportunity.

What The Data Really Shows

Overall, UK retail footfall is down slightly this year, around 1–2% year-on-year according to the British Retail Consortium (BRC), but that headline hides an uneven story.

While some high streets have been struggling over the last few years, others are thriving thanks to investment, local growth, or simply being easier to reach. Retail parks, for instance, have held steady and smaller city centres like Bristol and Leeds have outperformed many London postcodes.

National initiatives like the Pride in Place programme are also helping to breathe life back into selected towns, focusing investment on areas with real potential for renewal. It’s another sign that regeneration works best where data, local insight and community investment come together.

What The Winners Have In Common

The town centres holding their ground tend to share a few traits:

- Good access – easy parking or transport links that make quick visits possible.

- A reason to visit – food, leisure, community events or health & fitness alongside retail.

- Versatile spaces – smaller units, pop-ups, or mixed-use sites instead of long leases and big footprints.

- Concentrated customer base – regeneration, new housing, or an active local workforce driving steady daytime footfall.

The towns who are combining these elements aren’t just surviving, they’re slowly reclaiming their regular visitors.

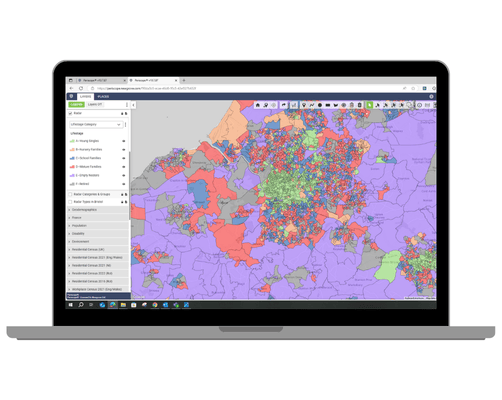

Periscope® brings meaning to your data because everyone sees the why, the where and the how.

The Reality Check

Unfortunately this isn’t a comeback story for everyone. For many towns the way back is still uphill as they are weighed down by high costs, limited investment, poor transport links and a retail mix that no longer fits how people shop. Recovery varies from place to place which is exactly why location data matters.

Understanding real movement patterns, catchment changes and spending habits helps brands choose which towns are worth investing in, and which may never bounce back.

Planning With Precision

If you’re planning new locations or local campaigns, it’s best not to rely on headlines about “high street decline” or “town centre recovery.” Both can be true depending on where you are looking.

You can use location insight to:

- Map real footfall using verified data

- Compare catchment strength and population growth

- Identify the centres showing consistent, multi-purpose traffic

Periscope® can visualise, complex internal and external datasets on your own corporate version of Google Maps.

Looking Ahead

Future growth will come from recognising how town centres are evolving and adapting your expansion strategy to fit. At Newgrove, we help brands pinpoint the locations with genuine growth potential. So, every decision you make is backed by data, not guesswork.

Expansion is always a risk – make yours an informed one using Location Intelligence. We’d love to show you how it can support your expansion plans.